Well I hope you like securities, as we’re diving headfirst deep into the stock market today. Might want to brings some snacks too because it is going to be quite the hefty Let’s Play introduction.

Today’s scheduled train service leaving for City of Hopes & Dreams is about to depart the station. Please ensure you have finished boarding the train and have your tickets ready for inspection by the conductor!

Let’s Play City of Hopes & Dreams - Groundhog day in A-Train: All Aboard! Tourism…

Click to reveal...

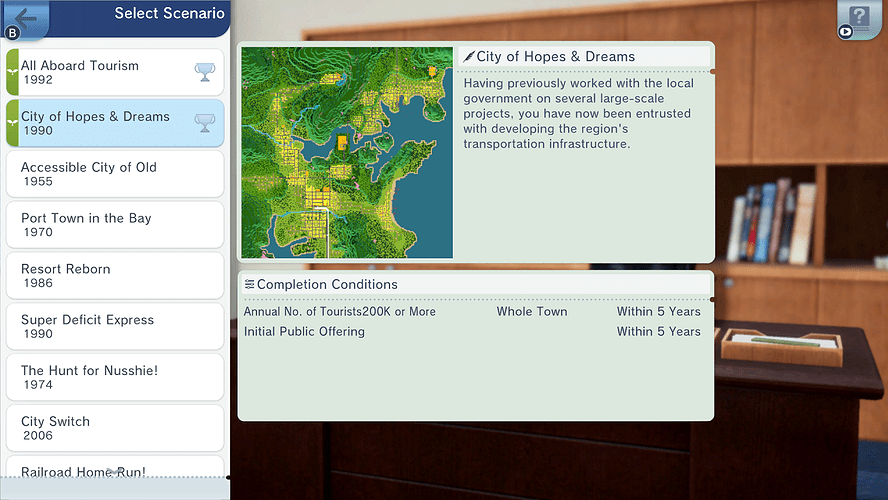

At long last, welcome back to A-Train All Aboard! Tourism as we reboot our playthrough of the City of Hopes & Dreams scenario on the PC version. Before diving into today’s business dealings lets take a moment to remember what our scenario goals and starting conditions are. So, without further hesitation, let us get going…

Whilst there are sometimes some minor differences between the Nintendo Switch and PC versions of the game, at the time of writing, everything showcased here should be cross-applicable. One such difference will be the amount of initial starting capital available to us for the scenario, which slightly varies between the Switch and PC versions currently. For the City of Hopes & Dreams scenario the difference in starting capital will be approximately ¥400,000, a minor loss in capital for PC version players.

Thankfully, our goals and deadlines remain exactly the same regardless of which platform we are playing on. Since we successfully dealt with the first completion condition in our Let’s Play of the All Aboard Tourism scenario it needs little introduction. However, the Initial Public Offering completion condition is one which we have yet to encounter and is introduced during the City of Hopes & Dreams scenario. So, time for a little refresher…

Broadly speaking, an IPO (Initial Public Offering) occurs when our private company begins selling our shares on the national public stock exchange. Which can also be referred to as a stock listing, since we will be listing our company on the stock exchange. Conducting an IPO can be an excellent way of unlocking additional capital, since any shares sold to the public during the IPO bolsters our company’s coffers. Listing our company on the stock exchange does come with its own unique risks and potential disadvantages though.

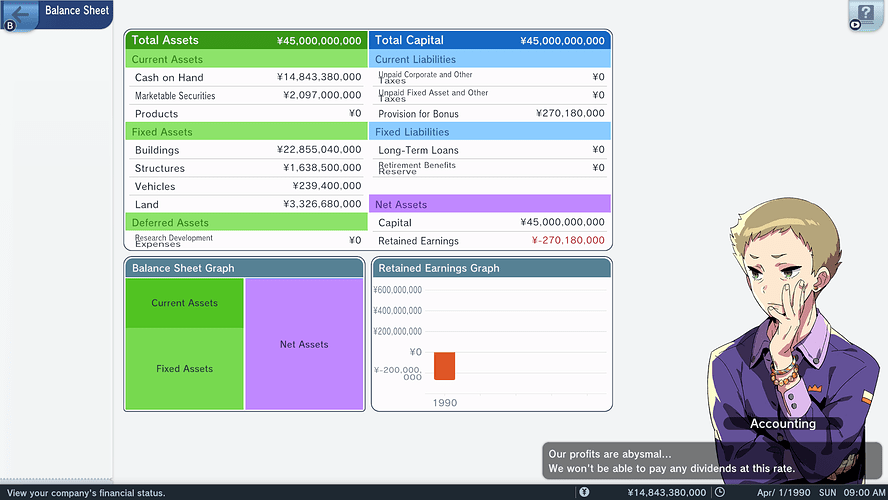

However, before our company can even begin to contemplate conducting an IPO we must first meet several key criteria. The first of those criteria relates to the current total value of our company’s net assets, which must be worth at least ¥9,500,000,000. Thankfully, this is something that we have already achieved. Our second criteria relates to something called Retained Earnings, which we will broach in detail later, and which must be at least ¥1,900,000,000. Finally, our third criteria requires the company to achieve a surplus for at least two consecutive financial years, prior to us instigating the IPO.

Determining our company’s Retained Earnings is as simple as consulting the Balance Sheet screen within the Reports menu. At the beginning of the City of Hopes & Dreams scenario we can see that currently our retained earnings are forecast to be in the negative with a loss of ¥270,180,000. This negative retained earnings value, or retained deficit, is due to the employee bonuses that our company will be paying out on July, 25th and December, 25th of the current fiscal year.

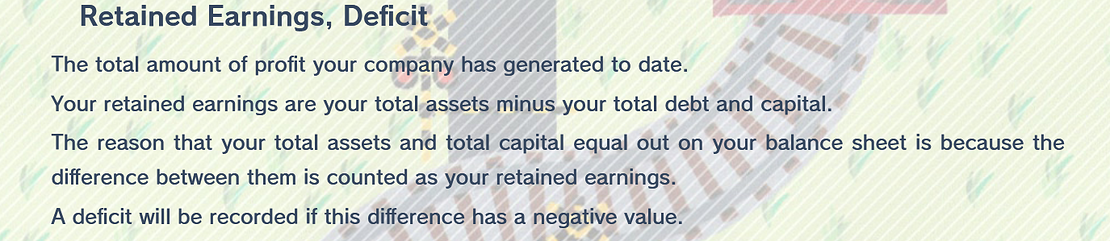

So, what exactly are retained earnings I hear you ask? Well the in-game manual defines it as such:

In layman’s terms, operating at a surplus will improve the value of our retained earnings whilst running at a deficit will worsen it. Thus, the easiest way to ensure that our company’s retained earnings grow year-upon-year is to constantly achieve a profit at the end of each financial year. Also, it’s important to note that any dividend paid out to our shareholders, applicable to Standard difficulty or higher, comes directly out of our retained earnings. Remember this while considering when to begin your IPO, as paying out a dividend will subsequently lower your retained earnings and may bring you back below the required criteria of the IPO plan.

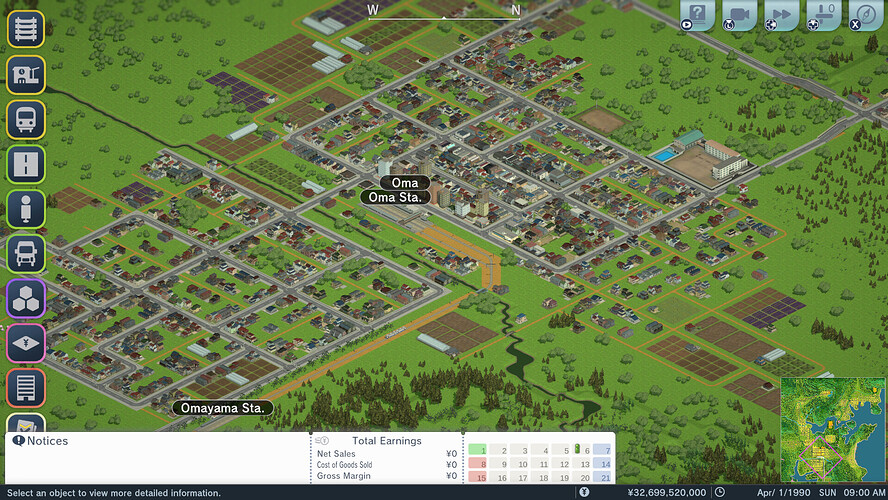

Now with that recap out of the way, let us crack on with the scenario. So, welcome back to the wonderful town of Oma, the epicenter of our fledgling business venture!

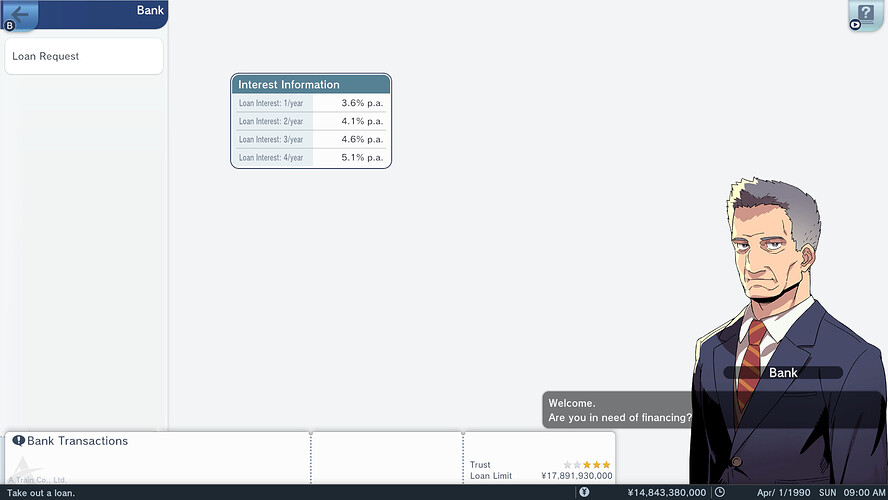

First on our agenda today is to visit the bank and have a meeting with Ginjiro Nasu to discuss taking out a business loan. Thanks to our three star trust rating at the beginning of the scenario we are able to take out a loan of up to ¥17,891,930,000, based on the value of our company’s current assets. Which at the current interests rates being offered makes taking out a business loan a very tempting proposition.

After much deliberation we decide to take out a four year business loan with the bank. Since our company aims to conduct an IPO within the time-frame of two to three years, we should easily be able to service this debt when the time comes. In return, the capital injection of ¥17,891,930,000 should allow our company to expand its business ventures quicker.

As a result of our business loan, our company’s total assets have now exceeded a valuation of 60,000,000,000 Japanese Yen. Additionally, our company’s cash in hand has increased from ¥14,843,380,000 to ¥32,699,520,000. Some of this capital we intend to invest into securities, an aspect of the game which we did not explore during our Let’s Play of the All Aboard Tourism scenario.

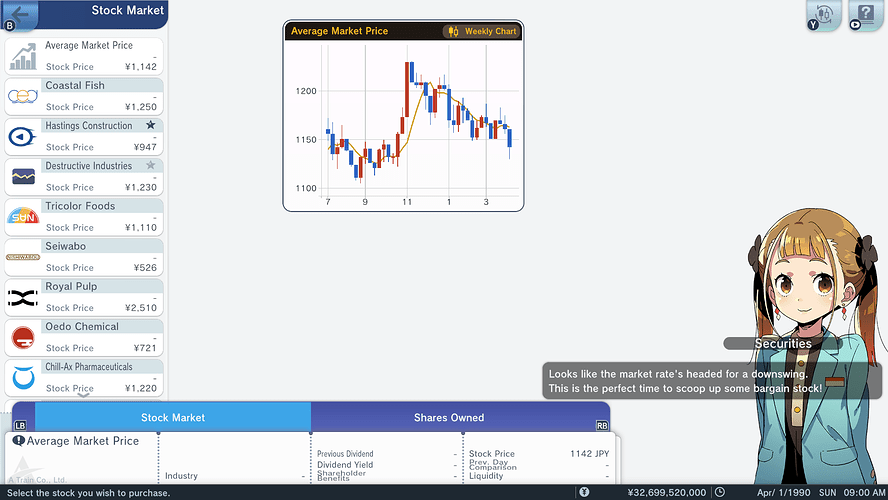

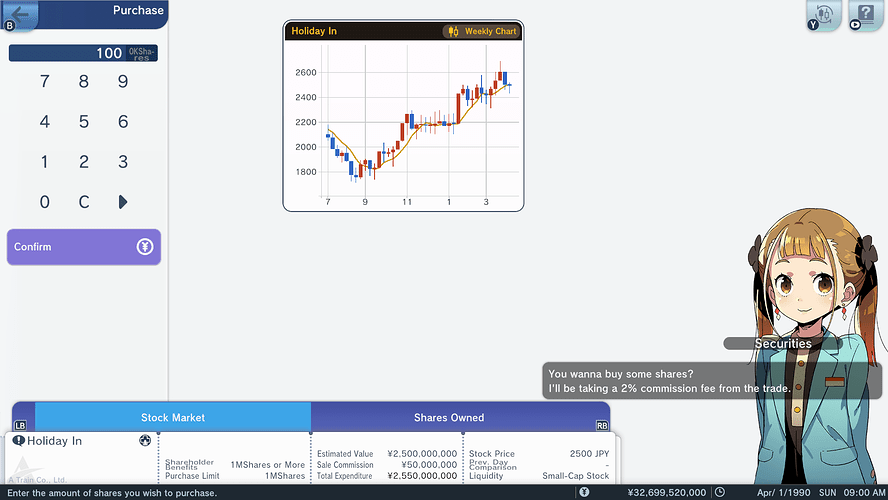

Thus, let us introduce ourselves to our local, friendly stockbroker Hina Amakusa. With the aid of Miss Amakusa our company will be able to wheel and deal on the Japanese stock market. Listed on the stock market are various companies of differing industry types, such as the construction sector and the service sector. The listed share price of these companies will fluctuate during trading each day and sometimes result in significant peaks and\or troughs across the span of a week, month, or year.

Owning shares in other companies comes with three key perks in A-Train: All Aboard! Tourism. The most significant perk comes in the form of ‘shareholder benefits’, which are given to our company when we hold the requisite amount of shares. You can quickly determine which companies offer a shareholder benefit by looking out for the little star next to the company name. For the City of Hopes & Dreams scenario we need to amass one million shares in a company to be eligible to receive the company’s stated shareholder benefit.

The second perk of owning shares in a company on the stock market is the potential to receive a dividend payout on July, 1st of each year. The dividend yield for each fiscal year depends on the performance of the company, thus the payout can fluctuate from year to year. Poorly performing companies often offer a small, or no, dividend yield on July, 1st. On the other hand, well performing companies will often offer a modest or good dividend yield. Exceptional performance over the financial year will often see companies offering an exceptional dividend yield of 10% or greater, a real treat when it happens.

The third and last perk needs little explaining, if our company buys shares whilst prices are low and then sells them when prices are high we stand to earn a tidy profit from it. The stock market wheeling and dealing we are all familiar with.

However, as outlined by the in-game manual, the maximum number of shares that can be traded per day depends on the stock’s market capitalization value. Consequently, the volume of shares we can buy or sell per day is subject to the liquidity of the company whose shares we are trading. According to the in-game manual, large-cap stocks are restricted to trades of ten million shares, mid-cap stocks are restricted to trades of three million shares, and small-cap stock is limited to trades of one million shares.

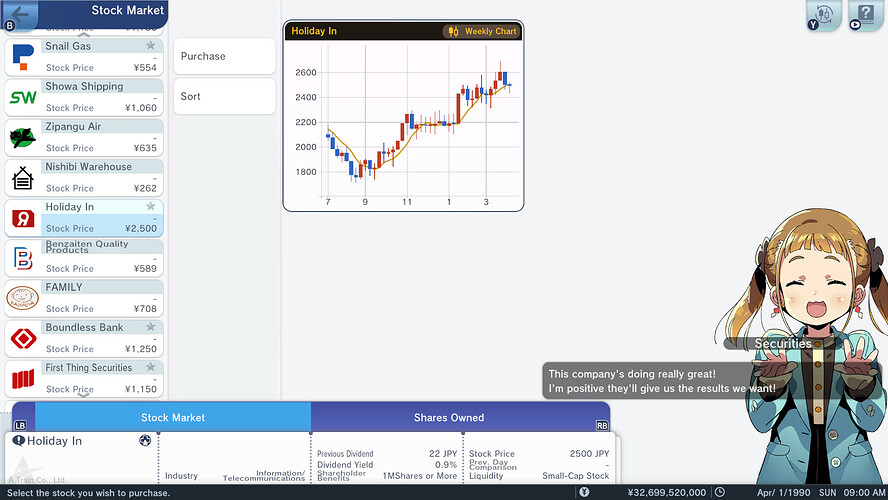

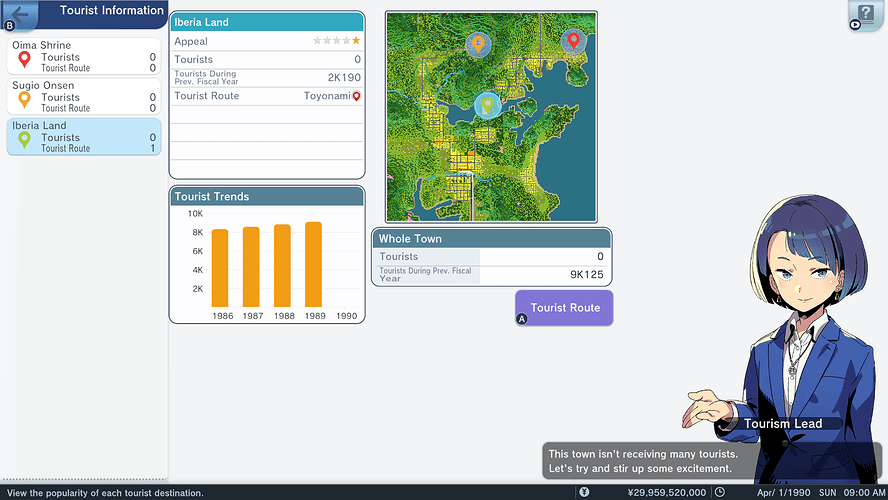

Examining the national stock market we fix our eyes upon Holiday In, a small-cap stock whose shareholder benefit is a 5% increase in the number of visiting tourists. Considering one of our goals involves boosting visiting tourist numbers, this perk could synergise quite well. Additionally, our subsidiaries at Iberia Land could profit handsomely from the increased tourist patronage. To acquire the requisite one million share would cost our company a total of ¥2,550,000,000, once Miss Amakusa’s commission fee is factored in.

Knowing that the scenario will take a minimum of two and quarter years to complete and flush with our capital injection from the bank, our company proceeds to acquire the one million shares of Holiday In. Our company expects the initial capital outlay will, at bare minimum, be recouped by the completion of the scenario. Though, the optimists among us are forecasting that the venture should provide a good ROI (Return on Investment) by the conclusion of the scenario.

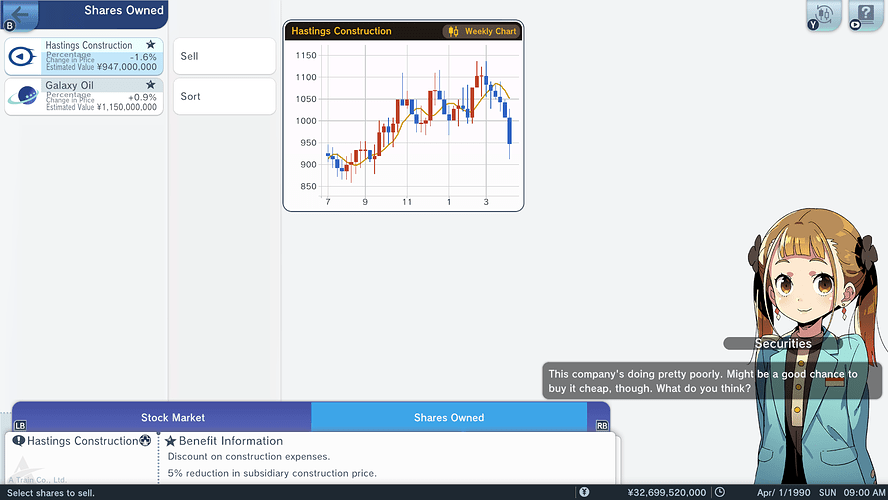

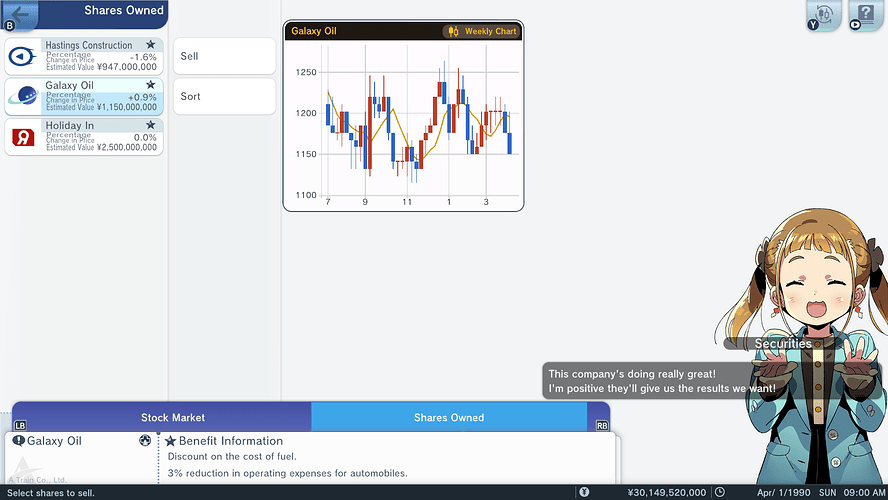

After concluding our stock trade our company now owns a total of three millions shares across three separate companies. Owning one million shares in Hastings Constructions, Galaxy Oil and Holiday In subsequently provides us with three shareholder benefits. A 5% reduction in construction prices for subsidiaries via Hastings Constructions, a 3% reduction in operating expenses for automobiles via Galaxy Oil, and the aforementioned 5% increase in the number of visiting tourists courtesy of Holiday In.

Next on our agenda is the expansion of our sales department. Enacting this plan will, upon completion, allow our company to work on two projects in parallel. Undertaking this venture will require an outlay of ¥190,000,000 and 20 day’s work. However, this should prove useful in the future due to the number of plans our company is expecting to enact during the scenario.

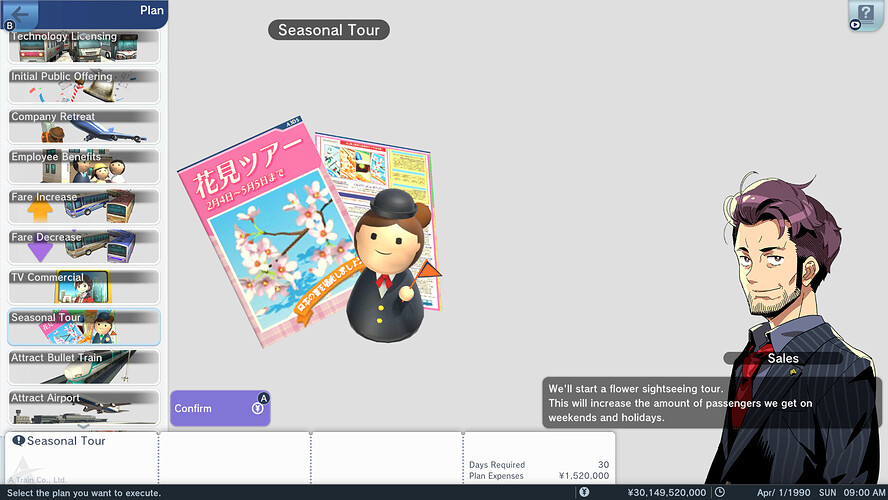

Once our company’s sales department has been expanded our company intends on enacting the ‘Supplement Staff’ and ‘Seasonal Tour’ plans. The ‘Supplement Staff’ plan has been discussed before and will be enacted to help our company meet its staffing requirements. However, the ‘Seasonal Tour’ plan we have yet to discuss nor utilise. The purpose of this plan is, as the tooltip explains, to boost passenger numbers across the weekends and holidays of the Spring season. It’s commonly beneficial to enact this plan at the beginning of each new season because the benefits to ridership occur for the duration of the Summer, Spring, Winter, or Autumn season.

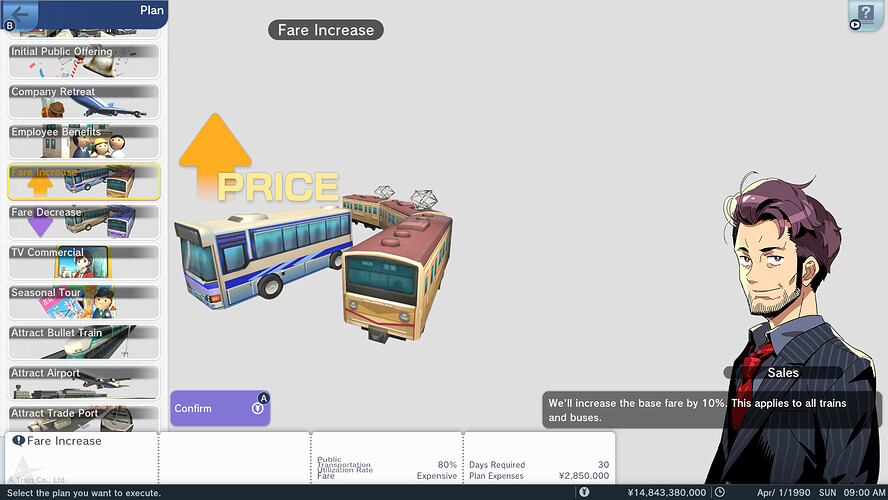

During the management of our business we may also want to periodically investigate the Fare Increase and Fare Decrease plans. When enacted, these plans increase or decrease the fares of all trains and automobiles by 10%. This can consequently impact the Public Transportation Utilization Rate parameter, which currently sits at 80%, and the public’s perception surrounding our company’s fares, currently seen as expensive.

Essentially, the public transportation utilization rate quantifies how many town residents choose to use public transportation to commute. Thus, the higher the utilization rate the more passengers we can expect to use our company’s transportation services. Conversely, a lower utilization rate often means lower ridership for our company’s transportation services. Town residents instead often choosing to commute by personal automobile where possible.

For the moment, our company plans to keep fares where they are and focus on increasing our potential pool of passengers instead. We can first achieve this by establishing more tourist routes and thereby encouraging more tourists to use our services. Secondly, we can expand the reach of our transportation network to cover more of the scenario map. Through measures such as these we can potentially boost the Public Transportation Utilization Rate parameter to 90% and above despite the public’s current perception of our fares.

With two tourist attractions and two neighbouring cities currently not serviced by our transportation network there should be plenty of room to grow our potential ridership. However, that shall have to be a matter for another day. Sadly, we have reached the conclusion of our first entry in this reboot of Let’s Play City of Hopes and Dreams on the PC version of A-Train All Aboard! Tourism. The company crew dearly hopes you can join us next time as we begin breaking some ground on our business plans for the region.

Until we next meet aboard the A-Train, our conductor Go Ise hopes you have a safe and wonderful journey!