This probably feeds into the “mid-life crisis” part of it, a bit. As you have older millennials reaching the top end of their 30’s at this point. And I think this was the first generation where people were pushed hard into going to college, for many of my friends into degree programs that were not good choices to make money. I chose biology, because I have a passion for science, and that was a good choice. Others who picked mathematics or music or english, have not done as well.

I think the difference is that we all spent a fuck ton of money on college compared to previous generations, and the labor market just wasn’t there when we graduated.

According to the Food Institute, which analyzed Bureau of Labor Statistics expenditure data from 2015, people from 25 to 34 spent, on average, $3,097 on eating out. Data for this age group through the decades was not readily available. But the bureau’s report indicated that this group spent $305 more than people from 55 to 64 — a group that encompasses some baby boomers — and $89 more than the overall average, including spending among people ages 35 to 54.

The truth is, even if millennials assumed the eating-out habits of baby boomers, it would take around 113 years before they could afford a down payment on a home (assuming a 20 percent down payment on the median price for a home in the United States, $315,000 in March 2017, and a 1 percent yearly yield rate).

As for Mr. Gurner’s second suggestion — skipping the European vacation — there is indeed an opportunity for savings, but research suggests millennials are the generation spending the least on travel.

Millennials spent $4,832 per year on vacations, just below the $5,078 by Gen-Xers and $5,012 by boomers, according to MMGY Global’s Portrait of American Travelers in 2016. The study surveyed 2,948 adult travelers with annual incomes over $50,000.

I think a lot of the pushback has to do with boomers and others complaining about how we don’t know how to manage our money, and that it is our own faults for being frivolous with our spending, when the data shows that just isn’t the case. We are barely spending more than the average person of any age on dining out, we spend less on travel, and more on healthcare and other everyday things.

I think the perception is, the world is so much a better place! You got to go to college! You have a good job! When the reality is, we just aren’t making as much as previous generations were at our age.

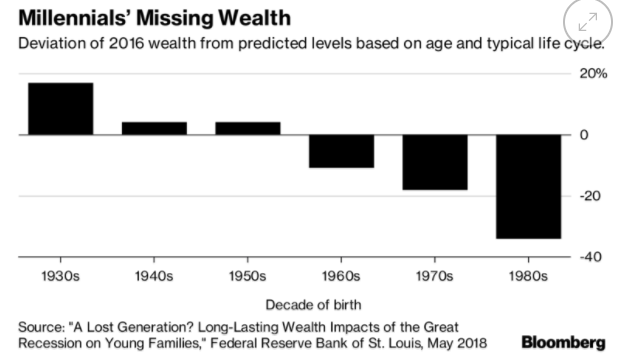

Of course, it’s perfectly normal for people just starting out to have less in the bank. However, the St. Louis Fed warned that, even when taking that into account, young Americans are slipping dangerously behind. For a time, Generation X was also losing out, thanks to the 2008 financial crisis. But its members managed to make up most of the shortfall in the years since, tapping into the longest economic expansion in decades.

For some reason that period of tremendous growth barely helped millennials. The St. Louis Fed called this anomaly “a missed opportunity because asset appreciation is unlikely to be as rapid in the near future.” That’s pretty bad news for twenty and thirtysomethings who may have been hoping to catch up.