When you wrote $354 I thought you meant $345,000. But $345.00? LOL

I assumed 3.5 Million, with 12 acres. But of course it depends on location. When I get these type of calls I just ask them to send me a check for roughly the value of the house and I’ll sell it to them right then and there. Oddly they never take me up on the offer.

No, $3.54, as in three dollars and 54 cents.

I’m laughing so hard right now 🤣

I just picture a little kid walking up with a handful of change saying “I have this much!”

A ziplock bag full of change.

Spanish edition:

355k for a 485 sqr feet apartment (and a garage space in the building).

The area is ok, but far from the most luxurious/expensive on the city.

The garage space is probably half of that price!

I jest, but only somewhat. In NYC a space in a high-end apartment’s garage can go for a cool million.

In this area that garage is 25 to 30k.

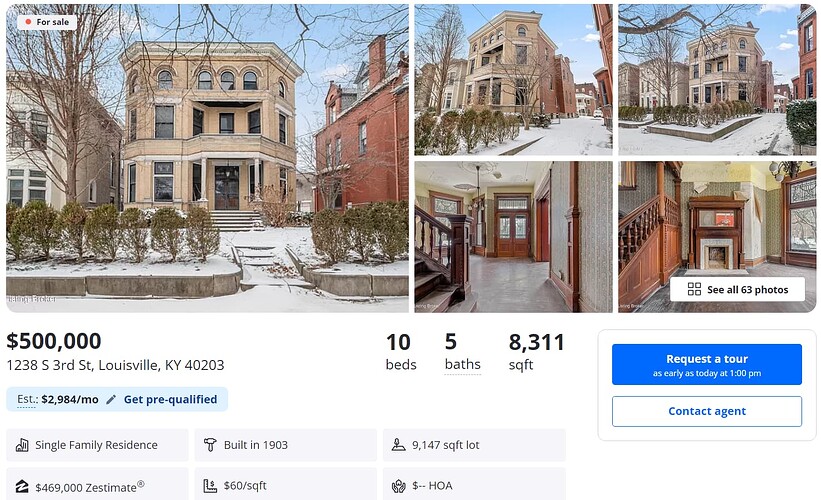

Not a crappy home, but a ridiculous price (I knew we had expensive houses in my state but not … this.) Also check out the estimated monthly mortgage lol.

Let me see what that would get you here in Utah:

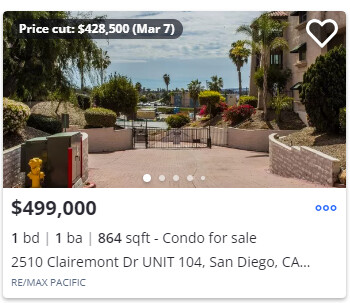

Here’s San Diego, in approximately my neighborhood:

There’s a $300k+ weather surcharge for any property in San Diego, I think. :)

Not just a coastal thing. I’m in a very high demand neighborhood built from 1973-1986ish in the suburbs of ATL. About a third of the neighborhood (it is huge, used to be biggest in GA) has been or is being torn down and rebuilt. 500k+ homes being bought to be demolished. New homes are going up for 1-2.5 million typically. It’s a bit odd driving down the street and seeing single story 50 year old ranches next to a brand new Mic Mansion. I’ll have to grab some pictures.

Edit to add: Market is not slowing down in my area. Maybe for like a month or two it did but full steam ahead now that spring/summer is here. I’ve appreciated 20% in 2 years with about 40k in work done.

Pretty similar here

Of course I can find some that are smaller and larger within $20k of this, but this is entirely average. It’s also a few miles east of me, away from the downtown, so runs bigger lots.

Might be a bit of a “later states” thing too, we have tons of 100+ year old houses and old neighborhoods that are in various states of gentrification/decline. I can get you that shotgun for 30k in one part of town and 400k in another.

Location is OP, I’m getting my old house ready to sell and will probably get a 75k bump just from being on the preferred side of the road vs. a neighborhood exactly like mine that you can see out the window.

I got a golf course lot with a creek outlining my property. It’s about a 25% uptick value from the house across the cul-de-sac. Silly.

Someone making $20 per hour working full time only earns a little over $40,000 per year. Even in lower cost of living small to mid-size Midwestern cities the average 3bd 2ba “family” home seems to be running well above $200K, and in more desirable school districts in suburban areas it becomes more like $300-$400K. The old simple rule of thumb was to take your annual income and multiply by 3 to get your limit for an affordable home, but that’s only going to be $120K for the $20 per hour worker, not even enough to buy a small condo in many areas. I suppose if you’re married and one spouse makes $40K and the other makes $25K working part time or something, then you can reach the $200K mark that might get you an older home that needs a lot of work. The fact that what used to be considered a “starter” family home (3bd, 2ba) is now running $400K-$500K in a lot of places is simply insane.

Even with 20% down at 6.5% the monthly mortgage payment on a $400K home is $2,000 BEFORE taxes and home insurance. We are telling kids it is acceptable to spend $40,000 a year on a college education and to graduate with $100K in student loan debt (assuming the parents paid the remainder) then welcoming them to the workforce with $40K-$50K jobs (when they can even get them) and expecting them to somehow build the American Dream in the 10 years between graduation and their early 30’s when cars cost $40,000, houses cost $300K and up and a third of their paychecks get eaten by taxes and health insurance AND we’re encouraging them to “start saving for retirement early!” on top of that. Then we wonder why people in their 20’s and 30’s are struggling so much. Fucking insane.

My niece graduated college a couple years ago and just put in an offer on her first home. It’s a very old (but renovated inside, at least) small townhome, around 850sqft. The cost was $385k with a mortgage rate near 6%, if I remember correctly. I don’t know how you get more “starter home” than that, and yet I don’t know how she’s going to afford it. Thankfully her parents were able to pay for her college and help with the down payment, without that I think she’s stuck living at home for the foreseeable future.