I’m the CFO over at a small manufacturing company - and yup, it’s all about cash flow baby. You (normally) simply don’t want to pay in advance for anything that is going to sit in your warehouse for too long.

- Obsolescence

- Damage/loss/shrinkage

- Warehouse space/utilities/rent

- Personnel to manage it.

We pay most of our vendors in 30 days, plus variable amount of time between purchase and production/dispatch, then we are paid by our customers 30/60/90 days from date of dispatch/invoice. The more you can decrease that spread between cash outlay and payment the better.

Ideally we keep maybe a three to four week supply of inventory on hand for any of the generic products we make and then any specialty products are delivered a week before scheduled production. It’s not unusual for goods to be delivered the day we are scheduled to produce it - which may be a testament to efficiency, but just about noone wants to deal with the stress/risk of a shipment being delayed or having to skip an order because the materials didn’t arrive in time.

The supply chain issues are a blessing/curse. We normally have a 3 week backlog. Today we are officially booking our backlog into February. Costs have gone up, our prices have gone up, customers can’t seem to get enough of us. Customers are on the verge of being desperate paying stupid prices to convince us to squeeze orders in. Our own buyers are living week to week/day to day. We are on allocation with most of our largest vendors. Per our vendors, if everyone got along and agreed to buy just enough to get by each month we wouldn’t be having a problem; however, everyone is hoarding. You maximize your allocation whether you need the product or not (we are doing it too). Some people are paying stupid prices in order to “snipe” a roll of paper that was specifically allocated for another customer. Some vendors are blocking any new relationships in order to service their existing relationships. We have frenemies that made multi-million dollar machine acquisitions, but cannot find a vendor to sell them basic goods because they never had a previous relationship (ie - purchasing corrugated cardboard for packaging)

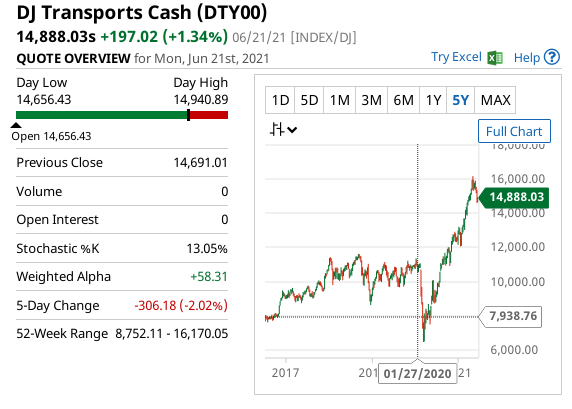

Labor is tough but getting better. I would say, on average, our cost of goods sold have increased about 15%. Freight is much worse - maybe 40-50%

Our freight aggregator says that going into the pandemic the US was already 100,000 drivers short. This will increase by another 100,000 every year for the next 10 years. They said something stupid like only 20k - 40k freightliners are being built every year?? They also stated that some trucking companies are paying 100k annually for new CDL drivers. Don’t know if any of that is true, but freight has been painful.

We don’t sell internationally and only occasionally buy equipment/parts internationally. We paid 60k for a small used machine from another factory in Sweden or Switzerland. Freight cost maybe 15k on the front end. There is a dearth of shipping containers in Europe. Took a month for a shipping container to be located, took a month for it to be delivered to the factory, took another month to truck it down to the coast, the shortest piece was shipping it across the ocean (2-3 weeks) to the East Coast. Took another 3 weeks to offload the boat at port - then the port got in contact with us and said it was going to cost us another 8k to offload the container due to shipping cost changes from the date we were originally invoiced (and paid months earlier). At that point it felt like a hostage situation, but we’ve been waiting on this machine for months already. We are really close to the coast, so it was delivered and installed within the week from there.