It’s true that foreigners now hold large claims on the United States, including a fair amount of government debt. But every dollar’s worth of foreign claims on America is matched by 89 cents’ worth of U.S. claims on foreigners. And because foreigners tend to put their U.S. investments into safe, low-yield assets, America actually earns more from its assets abroad than it pays to foreign investors. If your image is of a nation that’s already deep in hock to the Chinese, you’ve been misinformed. Nor are we heading rapidly in that direction.

I understand that, but Trumpalos don’t.

And I have no problem mocking their ignorance. Besides, it is still not inaccurate to say that we are borrowing money from Chinese investors to pay farmers.granted it’s not a direct transfer, and it’s messy, but the farm money is literally increasing the deficit which has to be covered by issuing bonds. And a portion of those additional bonds will be bought by Chinese investors.

Ergo the claim is true, just in a very indirect and diluted way.

It’s funny, but no one ever says “we’re borrowing money from scottagibson to pay for this!” But we are.

I’m a little skeptical about this (though not outright saying it’s wrong), because data on international capital flows is notoriously bad and hugely influenced by classification error (see eg this from just yesterday).

So while the holders of record are mostly domestic, I wouldn’t be at all surprised if a majority of the ultimate beneficiaries, ie investors in money market funds, mutual funds, hedge funds and private equity funds doing cash management with Treasuries, clients of US brokers and wealth management companies, etc, were foreign. It’s only really going to be the official investors like central banks that show up in the stats as foreign.

I mean, they kind of do. It’s usually expressed in terms of taxing our children, but it’s ultimately the same thing.

(Link not rendering)

Sugar Industry Is Exhibit A of Tariff Favoritism

Thanks, taxpayers: The farm bill shows how protections for big business become permanent.

I say that all the time. I was just saying it to my wife this morning. She says thanks.

Maybe Trump and his family liquidated their stock holdings and are waiting to buy back in when it drops low enough. Winning!

I don’t think they have much stock, they are leveraged to the hilt.

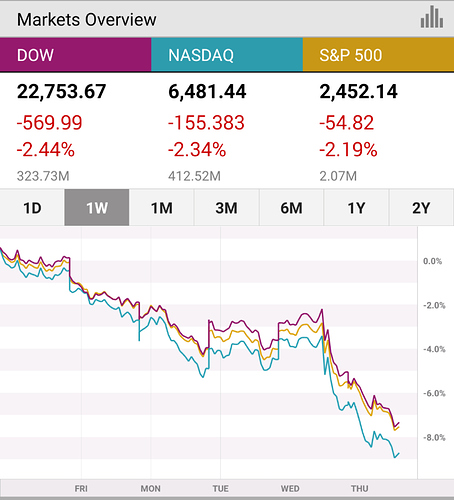

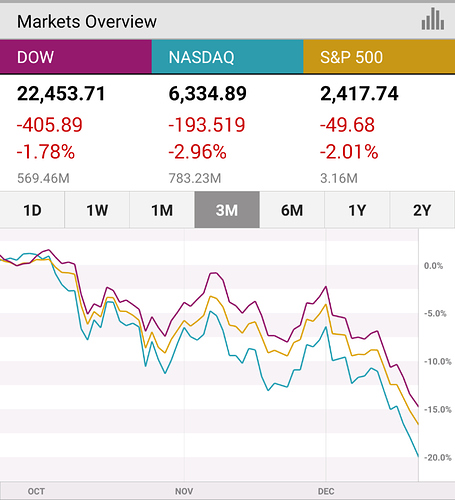

I’m not saying the sky is not falling, but the hyperventilating about the “Worst Stock Market Week in 10 Years” is a bit much. It’s not substantially worse than the drop in the first week of February this year. The market has been uncharacteristically volatile in the last year though, and it’s currently at its lowest point for all of 2018.

I think the main takeaway is that the market is down for this entire year. After months and months of bragging about how great the economy is doing, record stock increases, etc, the market has tanked over the past 12 months without a peep from our President of course.

He’s failing in everything he does and it’s finally catching up to him I hope.

I’d frame it differently. The stock market was uncharacteristically stable in 2016, 2017 (VIX was in the 10-15 range). It return to normal volatility this year VIX ~19. The last couple of months we have seen elevated over 20 and it hit 30 today, which is approaching the same levels we saw back in the fall of 2008.

A significant change from prior years is that the intraday swings have been very high. I did see a CNBC report that intraday volatility is at an all time, but I’m not sure if that’s true or how they measured it. The last hour of trading has been shit storm for most of the last month or so.

I’ve been living off my investments 19 years, and generally just stick my money in combination index funds, and dividend paying stocks (so no tech once I left Silicon Valley), with a smattering of CD, bonds. Lately, I’ve been buying real estate and Angel Investing.

Last time I did any major shifts in my asset allocation was back in Jan 2000, because I thought the dot com bubble had to end soon. and just as importantly. I could get TIPs bonds that were paying almost 4% (plus inflation) and muni bonds were paying over 5%, so I could live off my investment without taking a ton of risk.

I got blinded side by the 2008 crash.

The bull market has gone on too long and so we are over due for a correction or a bear market. Another 10% or even 20% isn’t the end of the world, and if you are still 5+ year from retirement a good buying opportunity. But what really feels different this time, is Trump and his band of incompetents or crooks. Trump instincts on the economy are pretty much 100% wrong and as we’ve seen with Mattis he doesn’t listen to people. If Trump had been charge in 2008, I think there is a chance the financial markets would have stopped working.

Unfortunately, I don’t know how to hedge against this risk other than guns, ammo and MREs.

I think he has peeped somewhat, by which I mean he has been slagging the Fed for thinking about raising rates.

I went and counted them up. This has taken Trumps achievements down to…

(rechecks numbers)

… zero.

Those emails tho

No offence to any investors (my private pension fund is several percent in the red for the year and I’m lucky that I won’t need it for a couple decades) but it is a little amusing that the uncertainty and dread that has constantly increased for wage laborers in the western world for more than 30 years has finally hit the stock markets.

But I guess that’s just the Joker in me wanting to see the institutions that brought us the Great Recession burn to the ground.

Buying some real estate to live in (unaffected by rising sea levels) is probably my safest bet for the future if I ever manage to commit to it.

Yeah, as a mere wage earner who isn’t retiring anytime soon, I too feel a bit of schadenfreude for those of the I class.