By bloated I don’t mean staffing levels or funding, I mean the tax code in all of its complexity, plus all the regulatory apparatus. I agree about the funding thing, for sure.

Indeed and I agree with this completely! One day, MAYBE they will make it easier. Maybe.

Are folks still waiting on their 2022 tax returns? I mailed mine off in April, haven’t seen anything, and IRS doesn’t seem to have info on their site about it when I entered it in? Getting worried.

I filed the final return for my dad in February, and only had it processed last week.

If you’re mailing the return instead of filing online, I highly recommend (in the future) sending it via certified mail. That way, you get proof that it has been received.

I would definitely file online, either through your accountant or turbotax or whatever. I like the notification that your return was accepted and you’re done for that year.

Next year, given that I have 2 employers and 2 legal names , I’m definitely letting someone else do the taxes. I’ll have to pay state taxes because I didn’t get those taken out for 6 weeks this year.

(I have a very corrupt and/or incompetent contractor right now, who is also threatening us with lawsuits if we say how bad they are)

I can tell you that if your mailed in tax return had a problem, either on your end or theirs, you may still have a long wait. Because of the pandemic and the pre-pandemic plans that closed two IRS service centers the IRS is way behind.

Another problem was the multiple filing by millions trying to get their pandemic checks. That event by itself has been a total sh*t show.

PS…I retired from the IRS last year. I have a daughter still working there. She is literally working returns from 3 years ago.

PSS….E-file if at all possible.

The letter I got today 4364c, confirmed they have processed my amended 2020 tax return. :)

Ruh-roh

Figured I’d choose this tax thread to bump with my question.

So for the first time in basically forever, my wife and I owe taxes this year. I’m pretty sure it’s because of the new W4 forms and how withholding is calculated. For over 10 years prior, we’d been at different jobs where our old W4 forms were filled out as “Claim Zero” and done. We both got new jobs and this past year is the first full year that our new jobs make up 100% of our annual income. And we owe. Not a lot, but enough. I’m trying to get her to go to her HR Dept and check her W4, since the amount of tax being withheld on her check is tiny for some reason.

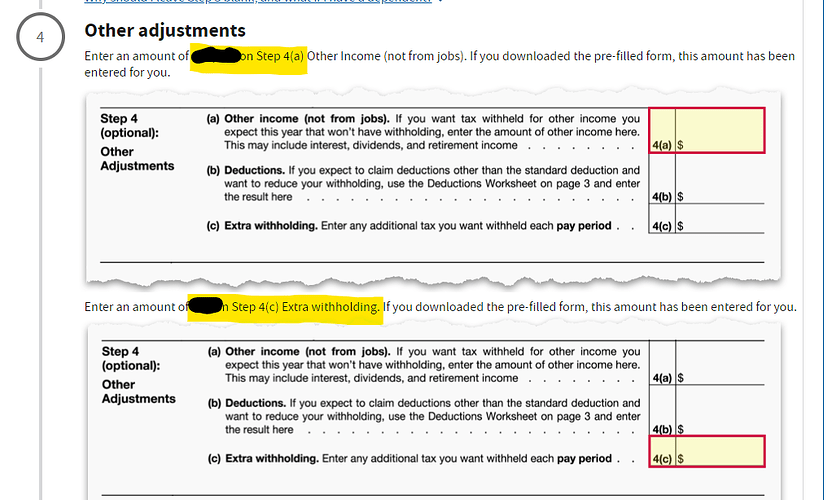

BUT…in the meantime, I’ve been trying to use the IRS Withholding Calculator ( https://apps.irs.gov/app/tax-withholding-estimator) to tweak our forms. Or my form, at least. Anyway, plugging in all the numbers from our most recent paystubs and the calculator spits out a number that we will owe at the end of the year. OK. It then gives me instructions on how to basically get my refund/amount owed to around zero, and that’s where the confusion is.

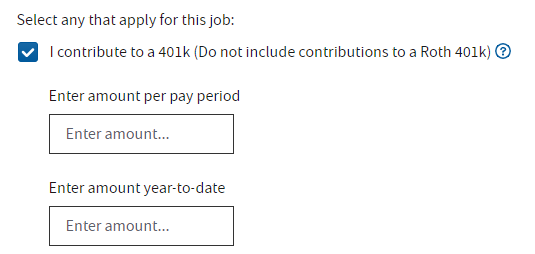

I get the second line just fine. That number, multiplied by by 26 pay periods basically equals what we’ll owe next year. But it’s the first sentence that throws me. That amount that they’re telling me to enter on Step 4(a) is the total of contributions made to our 401K plans, which is supposed to be pre-tax? Any idea why they’re telling me to list it here for additional withholding?

Thanks in advance, apologies for the long post.

I’m no tax expert, but here goes. Are you withdrawing from your 401K right now? If not, it’s not income (yet). That question is about someone who is earning from wages and also drawing on retirements (e.g., stuff you see on a 1099-R form) Once you start withdrawing from your 401(K) it is income in the year you withdraw. The money goes in pre-tax, but it is taxed once realized as income.

Nope. Just working the job and contributing in as usual. Her too. But after I typed this, I did see some info on HER pay stub that made me screenshot it and send it to her to fix. That might help with the withholding overall, but my questions with that stupid IRS Calculator still remain.

If you’re not drawing retirement, then no, you don’t enter any 401(K)-related amounts in 4a.

I figured. Just curious why the calculator is telling me to based off this question:

Presumably because they asked you somewhere in the form for gross wages. They need to know the affect of 401(K) withdraws on what is your taxable income (e.g., wages - 401(K) contributions).