“I fall just above a tax bracket”. Are republicans congenitally unable to understand how marginal rates work?

Ayup.

To be fair, that deficiency is not a liberal/conservative thing, whatsoever.

Yeah. This has nothing to do with politics. The general public doesn’t understand marginal tax rates. If they didn’t encounter it during their educational years, and most don’t, they just don’t put any effort into understanding it, regardless of party or even age it seems.

They should shut up and be happy for all the corporate stock buybacks and the Koch and Mercer tax relief. #MAGA!!

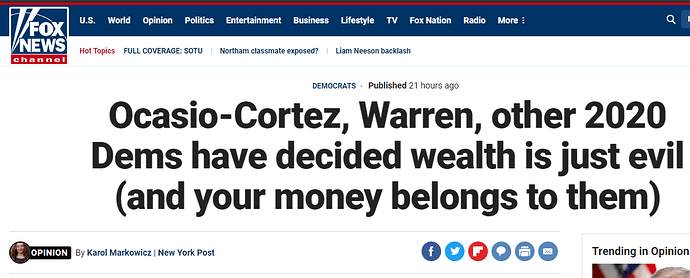

Lack of understanding may not be idealogical, but there is an idealogical push to make sure people continue to be ignorant. To wit:

*not technically your money unless you are part of the top 0.1%

*doesn’t technically belong to AOC/Warren/Dems, but to the duly elected Congress that represents the interests of the society at large that allows egregious amounts of wealth to be accumulated in the first place

I kind of grind my teeth every time I come across this. We as a society face a lot of really complex problems and it would sure be nice if people put a tad more effort into understanding them.

I think we will be getting back about the same as last year, maybe a bit more? Definitely not a noticeable “cut” like we were promised. Got married though. The doubled standard deduction simplifies things a lot in filling things out.

I think we refer to them as “diners”.

I was just about to post this in another thread.

Who would have thought that the 99% would prefer a policy that only effects the 1%… or at least the 70% that aren’t deluded that they might be part of the 1% some day.

This is honestly what the Democrats should have been pushing for a while

Don’t worry about tax changes that are at all debatable. Don’t talk about anything under a million bucks a year.

Go for the super top. Because arguments against taxing the ultra rich end up sounding real dumb.

They’ve always gotten hung up in arguments about taxing wealthy folks… just side step that. Don’t even worry about it. Just tax the folks with millions of annual income.

It won’t get you as much additional revenue… But it will still get you a big chunk of money.

I mean, you can see it in the polls, the AOC proposal of 70% marginal tax above 10 million has 64% support, but the Warren proposal is 70%.

It is REALLY difficult to argue with Warren’s proposal. 2% tax on those with estates of over 50 million? Buy one less Picasso for your yacht, and we get more money for roads and schools? (and fucking border security while we are at it)

You’ll take that Picasso off my yacht over my dead body!

Unless it’s the estate tax, and then suddenly everyone dreams about that ultra rich uncle they don’t know about leaving them money.

We must always remember that poor teacher making $50k that just inherited $50M and will have to pay tax on it. TAX! Socialism!!

Just so we’re clear, none of this stuff will affect the single mom making $250,000 a year with $40,000 of it being investment income? Or the $650,000 a year family of four? Because I don’t want to hurt the average American.

What about someone like me, $490,000 a year from salary, $89,000 from investments, $125,000 a year given to charity?