It makes perfect sense once you realize that the Republican Party has become a party of grifters. They know the backlash is coming and their majority isn’t going to last long, so they’re grabbing all the loot they can while they can.

The rich may pay a huge portion of income taxes, but that’s as it should be, especially when their share of the national income is growing (and has been growing) much faster than everyone else’s for the last 30 years or so.

The House version didn’t lower the top rate. Although, for somebody making more than a million dollars raising the start of the top rate to $1 million from the current $470K does provide them with almost 25K in tax saving equal to 20 median family income saving.

I think it is possible if they take best part of each chambers bill to make less favorable to the rich and little fair to the upper-income folks in the coasts. So for instance, allowing a deduction for taxes but capping at $10K is not unreasonable, keeping the upper rate 39.6% and several other things.

I don’t know if it’s enough would make it 20% less evil so that Kyrios would support it. I won’t bet money this will happen though. As I said at the beginning of the thread, there is no economic justification for a tax cut with today’s economy, and it is bad public policy because running a big deficit during good economic times is very dangerous, because what do you do during another recession. So I really can’t get aboard supporting the tax cut, even while I like most of the reform aspects of the plan. I agree with Sharpe it is really awful policy to borrow money to give everybody a tax cut, that future generations will have to repay. Thank God interest rates are low.

I’m genuinely on the fence about the corporate tax cut. I think we need a lower rate to remain competitive, but I share the skepticism that much of this will trickle down, on the other hand, cutting corporate tax has worked for some states and countries, and we all could be wrong.

But my comments are mostly on the politics of the plan. Don’t believe the Democratic talking points that it is only a tax cut for the rich. That’s really not true, it is a tax for everybody, and the rich benefit a lot because they pay most of the taxes. Congressional Democrats and the progressive press have whipped the Democratic base in frenzy predicting doom and gloom.

People have widely different ideas of fairness, I’ve seen folks making 25K a year be highly supportive of a flat tax. “Everybody pays their ‘fair’ share.” So the argument, “who cares that average family save $100/month, the multi-millionaires are saving $100,000” will often be met with a shoulder shrug. “Well duh, they pay more taxes, and you liberals lied and told me it won’t save me any money.” I predict it is going to be popular with the base, and among the vast majority of folk who see a lower tax bill. I’m dubious there is going to be a big clamor for repeal.

I believe you’re right, though not necessarily for the same reasons. Many individuals will see a lower tax bill for several years, and so won’t have a major stake in supporting repeal. By the time those cuts are set to expire, pressure will be on Congress to make them permanent (“tax increase on the middle class” will be the headline). The corporate rate cut has no direct effect on most voters, so the pressure from donors will greatly outweigh whatever pressure exists to repeal that.

The real push to change tax plans is probably going to come when cuts are made to spending. Assuming there’s a Congress that can be convinced to increase some kind of tax, it’ll be done in small chunks to save specific popular programs, not as a wide-based repeal of the Trump tax cuts.

Papageno already said this, but it bears repeating: Yes, the rich pay a huge proportion of the taxes, but not as high as their proportion of the wealth and income. They are already getting a great deal, they don’t need a better one.

To be fair, I’d probably prefer that it be about 80% less evil. What I’d want isn’t too far off from what @Sharpe wants - hell, add a tax cut for all earned income under $100K or $200K in line what this bill is giving, if you really want to put some downward pressure on federal revenues. That plan hits the classic fiscal conservative goals of simplifying and letting the market do its work, might actually help the economy, would be much “stickier” and harder for Democrats to replace, and while Armando would still want the bourgeoisie up against the wall (❤️ ), everyone else under 40 would just shrug and go about their day. Better for America and better politics.

The Mercers wouldn’t be happy, though, and we’ve been told explicitly that that’s what it’s about, so…

Again, you’re being less than accurate here. Sure, there is some rhetoric that it’s all for the rich, but the majority of elected Dems I’ve seen point out not that but how much of it is weighted toward the top.

All of which misses the point that for a nation running ~$600b deficits starving the Treasury of yet more revenue is probably not the greatest of ideas.

The ACA changes will likely drive rates up by more than the tax savings. so it’s a wash, but the rich deffinitely get richer, by a large amount. So yeah, it’s screwing the vast majority of the country to help the rich get richer.

And the poor grad students and self employed folks in the gig economy are going to get hammered. And we can’t find 15 billion to pay for CHIP (but 1.5 trillion in debt for benefits to the rich is no problem), so 9 million kids will lose insurance coverage and go to the ED instead of a clinic - horrible for their overall health (the ED doesn’t do preventative medicine/immunizations, etc) and so very expensive.

Really a terrible, horrible, no good, very bad tax plan with far ranging implications that was passed before the people passing it could even read it. And we need to just keep hammering the GOP for it for the next three years.

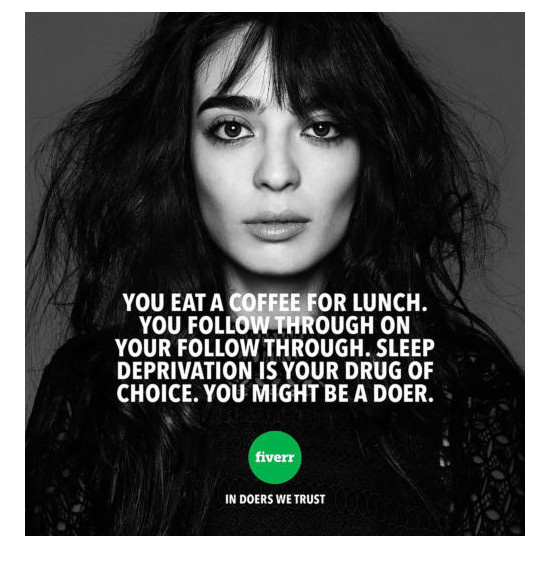

Don’t worry about those giggers, they’ll be fine! It’s cool to hustle for scraps while depriving yourself of sleep and nutrition!

Don’t forget the annoying provision that prevents companies from giving employees gift cards and gift certificates as small spot awards.

Here’s a calculator I found on reddit for those interested. Seems about right from some of the manual calculations I did.

If that tax calculator is accurate, I will pay less in federal income taxes under both the House and Senate plans. The savings under each plan is larger than the share of debt that will accrue to me per capita, so it’s a net boost for me however you slice it. However, I still consider it a bad plan for all the reasons listed above. Even if it benefits me in the short term, it’s bad for the bulk of the population long term.

One thing that I’ve consistently noticed about Trump supporters and Republicans in general lately is that they can’t understand this line of thinking. If something is personally good for them but bad for most of the population then it’s great and something to celebrate. They don’t have the empathy necessary to accept any type of negative impact on their own situation, even if it’s for the greater good of the less fortunate population.

- A stupid border wall makes them feel safer somehow, even though it’s idiotic, pointless, and would negatively impact a lot of folks.

- Same with the Muslim bans.

- Tax cuts help them for the next years while drastically affecting others negatively. Will likely hurt them as well in the long term once certain aspects are phased out.

- Gays shouldn’t be able to get married (or let’s face, even exist) because it somehow hurts their view of marriage.

- etc, etc, etc

Hrm, I plugged my 2016 numbers in and the “current plan” is lower by nearly $18k than what I actually had to pay for 2016.

Edit - oops, didn’t remove state taxes from deductions. Still came in $12k lower than what I actually paid.

Edit 2 - Christ, it’s too late to be doing taxes. After factoring in AMT it’s $3k lower than what I actually paid. I guess that’s not bad.

Holy shit. If you’re ever bored and decide that mailing money sounds like a good way to pass the time, then I’ll happily send you my address. :P

These are all small to very small numbers. There are 1.7 million graduate students say 1 million would be affected (assuming college don’t raise stipends or figure out some type way of providing discount tuition that isn’t taxable). That’s .3% of the population. Given the huge lifetime income gains for having a graduate degree, especially a STEM graduate degree, I’m guessing this group isn’t going generate a ton of sympathy.

Rougly 15% of the population buys insurance directly. For a large chunk of us, ACA hurts not helps. We are stuck with higher premiums for coverage for stuff many of us don’t need. (I’m fortunately I’m covered by a grandfather policy.) Really two groups of people are helped by ACA folks who have pre-existing conditions, AND and had no insurance before ACA. As best I can tell that number is in the low millons, The second group of folks who get an ACA subsidy, if you are being generous that maybe 10 million folks. When we look percentage who get a $100/month subsidy enough to offset the tax cut drop is in the neighborhood of 5-8 millions. It is lot of conjecture that tax plan will drive up ACA rates. It is even more a conjecture that anyone will be able to definitely sort out that Joe ACA premium increased 25% next year and 1/2 that is because of the the tax plan.

The problem isn’t the middle class tax cuts, as a majority of people will realize some savings, albeit small - my SO and I, not married and filing singly - net together ~$1200 savings. That pays for our Dunkin Donut coffee habit. Woo. As others have already said, this is an enormous shift of wealth to the top with no discernable benefit to the country as a whole. We’ve been doing this for the past 30 years - wages are stagnant, our infrastructure is ancient and dangerous (see: Flint et al), we’re not investing in post-secondary education, or research, or climate change mitigation/carbon reduction, etc., etc., etc. It’s not only bad public policy, it’s just simply bad. And that’s not counting all the shitty shitty aspects in this bill that has nothing to do with taxes (or the carve outs for “religious institutions”, which is more bullshit.)

Spin it anyway you like it, but saving enough to buy coffee for a year while everything else turns to pure shit is not an equitable pay off.

I don’t think Dems are going to take those painful steps. I think they’re going to take a page out of the Republican playbook and not pay for the changes. If paying for it means Republicans come back and make things worse, why not put off making things worse and let someone else deal with the problem later? There were reports coming out yesterday that some Dem Senators were saying that they should have just given away free insurance with the ACA and blown up the deficit instead- we wouldn’t be in this mess now if we had done that in 2009.

I’d be a “winner” under this plan of around 1300. That said, that’s dependent on keeping my job, and I think this bill could cost me my job, and that 1300 is going to be entirely eaten up in health insurance hikes (got 300/mo coming next year no matter what)

I hope they fix it (carried interest, capital gains). close the loopholes, raise the cap on SS, etc.

By the way, I severely underestimated the mortgage deduction we take. My SO takes the deductions. She ends up saving a whopping $154 with the Senate plan. If we got married and filed jointly we’d realize a bigger gain.

Our cheap ass company will not pass whatever tax savings they might realize onto us, either. (And apropos of nothing, but example from the craptastic US health care system - my SO had some medication to make her breathing better at night; was $30/mo - after the insurance change that same medication is $372/mo. She understandably said fuck that.)

I’m not worried about if STEM grad students generate sympathy or not. They are simply not going to be able pay that tax and will be forced to do something else with their lives. I’m worried that Americans in STEM grad schools will become a thing of the past. Will we someday be saying “Remember when the U.S. used to be competitive?” and “Remember when the U.S. used to have big research universities?”

You can argue that we will just “figure out some type way of providing discount tuition that isn’t taxable”, but then the country doesn’t get the tax income and it was just the government imposing a useless administrative burden/cost on the schools (the process of ‘figuring it out’ - I sort of thought conservatives were against costly but pointless government mandates). If the grad student tax is expected to have no effect, then why the hell keep it in?

0.3% sounds like an absurd number in relation to how upset I think we should be, but the income generated will be minuscule and the long-term damage to the country is potentially enormous.