Cue DDOS from outraged cryptokiddies.

If that’s true to others trying to process bitcoin for payment, it spells the end for this bubble, mighty damn quick, too.

This is why cryptocurrency is still the Wild West of investing.

Official statement from NiceHash:

The thing is, you can’t even tell if it was actually hacked, or some dude there just pocketed the money. There is no regulation on any of this.

For fucks sake, one of the biggest “Banks” was originally a magic the gathering card site.

It’s like bank robbery in the 30’s without all the guns and potential death.

I’ve always loved that tidbit of cryptocurrency history.

“Mt. Gox? That’s some kind of secure mountain vault thing like NORAD but for bitcoins right?”

“LOL. No. It stands for Magic The Gathering Online eXchange.”

“Uh, what?”

Except Magic cards are easier to secure since they actually exist.

If you buy a Black Lotus, you can put it in a safe. Or a bank.

If you buy a bitcoin they’ll hold on to it for ya. Someplace. Sort of. It might just not be there next week.

I always think of Bitcoin as the Myspace of Cryptovaluta - I don’t know much about it, but the demand seems to be there. Bitcoin is probably just the case that cracks due to the newness of it all - something will come along after bitcoin cracks, if there is enough supply, that will get it right.

I mean, it’s just digital money laundering really. Eventually the transaction fees will be immense, but it will still be popular because it’s safer than shuffling your drug/arms money through the banking system at the end of the day.

Or it will just completely collapse overnight.

The state-level actors in Russia and China and smart drug dealers worldwide are just laughing their asses off at dumb Americans and Europeans who are allowing them to launder all their money.

And the fact that none of these bitcoin thieves has been killed yet shows just who’s stealing the money. Hint: it ain’t the dumb Americans and Europeans.

Just like any speculative opportunity, if you go into it knowing it’s purely gambling based on crowd trends and you’re prepared to lose your “investment” just as easily as profit, then you might be okay. If you drop your life savings into it because someone told you cryptocurrency is the wave of the future and fiat currency is dying, then you’re likely not going to come out of this without some crying.

If you want high risk, high reward investments, there are a hell of a lot of opportunities that are better than bitcoin.

For instance, I invested in Sirius, the satellite radio company, when it was almost entirely devalued on the stock exchange. Its price was down to 16 cents when I bought it. But I listened to satellite radio, thought it was a good product, and figured “What the hell… they actually own things flying around in space. They gotta be worth more than 16 cents.” They were being heavily pushed down by short sellers, but that can only hold up for so long.

Sure enough, they rebounded and now I’m sitting on something like 3000% profit.

It was the same kind of longshot bet as bitcoin, but infinitely better since I was actually investing in a thing that existed.

Wait till you guys find out that the numbers you see on your online bank account aren’t real things either. Sure, they are backed by a bank and to a lesser extent by a government. Sure, also, bitcoin makes it easier to launder money and has experienced many scams and theft. But the whole “but bitcoin isn’t real!!” thing is just dumb.

To be honest I think they should have pegged the exchange rate to the USD and have a mechanism for releasing/taking bitcoins whenever the demand for the currency fluctuates. It’s worth as a currency is useless when it fluctuates so much.

My own personal major issue with bitcoin is the amount of environmental resources utterly wasted from the mining process. There are some other crypto coins that are innovating in this area, but as it stands I think cryptos are an initiative that as a species we should be looking at only after the world gets all of its electricity from renewable resources.

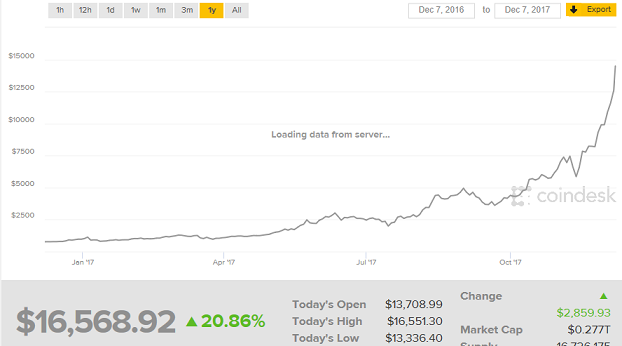

That graph is a lot crazier now, going up another 4,000 in just two days.

That’s a pretty damned major extent.

China’s major bitcoin exchange, which was shut down by the Chinese government under their anti-speculation laws, struck a deal this morning with a firm in Japan to host all their accounts and services there, meaning Chinese bitcoin owners and speculators are now back in business. That’s probably where the major spike is coming from.

On the flip side, another major exchange just lost $60mil in BTC (as Telefrog linked above), so risk is still at an all time high.

Basically, if you toss a couple hundred or a couple thousand at BTC, if you’re looking at it as money you’d take to the casino and play craps with, you’ll be fine. If it’s money you should have put in your 401(k) or used to pay the rent…stay away. The bubble will burst, it pretty much has to if cryptocurrency has any hope of ever being used as it’s designers intended. It’s impossible to exchange X for goods and services when the value of X is ridiculously volatile (as Steam explained in their suspension of BitCoin).

Yep, this I completely agree with. Great way to think of it.

Which, ultimately, may not have been the goal of Bitcoin. But that seems to be where it is, or maybe where it’s headed.

Several major exchanges are listing (cash settled) bitcoin futures this month:

http://cfe.cboe.com/cfe-products/xbt-cboe-bitcoin-futures/contract-specifications

How those will actually work in relation to the underlying markets given the fact that they are cash settled index spot priced based and the overall volatility of the BTC markets is fascinating.

I still don’t understand what work people are actually accomplishing with all these dedicated bitcoin GPUs. Folding@Home I can understand.

And indeed many of the members of those exchanges are very unhappy about it. How do you set robust margin levels for an asset that has increased in price by 50% in a handful of days and frequently falls by 30% or more?