This is quite the thing.

When you can’t tell who the mark is, you’re the mark.

Oh man, I need some milk chocolate bitcoins!

Finally, some bitcoin worth buying :)

I have zero problems with the AARP scaring their target market away from Bitcoins.

That is great. Also, I love their definition of Block Chain -

-

A different bunch of computer code containing an unalterable record of a series of transactions. The most famous is a digital ledger recording all bitcoin transfers.

-

A word often uttered by companies hoping to snare investors’ attention — and dollars.

The AARP likes to throw Shade!

Number 7 is really important for people.

Fiduciary

Among financial advisers, one obligated to put your desire to make money ahead of the desire to make money from you. Caution: Fiduciaries are like hotties on a dating app — not everyone who tries to look like one actually is.

Just a minor scam.

World news, as interpreted by Bitcoin monomaniacs:

Yes, clearly the important thing about this is Deutsche Bank getting its karmic comeuppance for calling something that is regularly used by criminals something that is regularly used by criminals. The nerve!

The best part, though, is the final line:

This week meanwhile saw Frankfurt host Germany’s second Bitcoin ATM.

There are two of them, guys. Two of them! In another ten years there might be three!

That’s awesome.

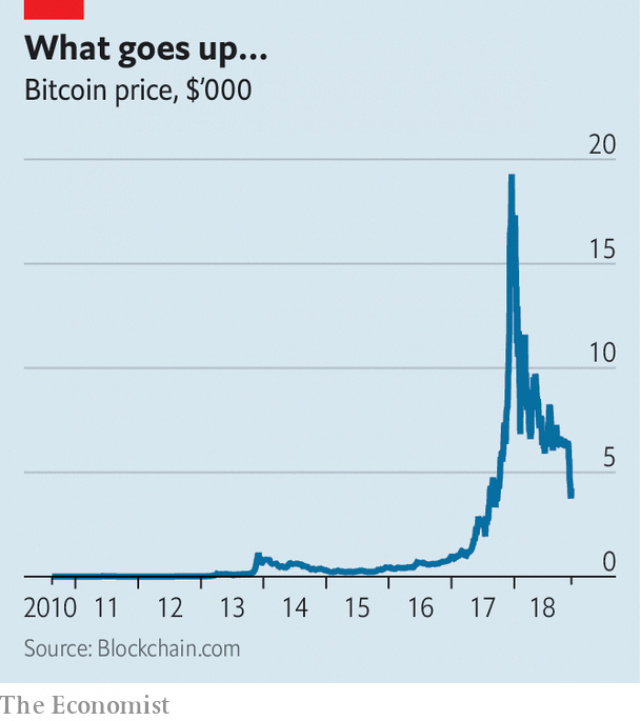

Meanwhile, a lot of idiots have lost a lot of money. Imagine being the guy who bought at $20k.

I am just mad that in the Fall of 2016 I didn’t buy bitcoin, like I was thinking of doing. I would have gotten out once it hit 10k and been happy with my free money.

You and me both, lol

Instead I invested 2,000 in the stock market. Which has given me a 3% return (was 14% earlier this year)

That being said, I do like Betterment, which is what I used.

Though, crunching the numbers Fall 2016, 2k would have netted ~2.5 bitcoins, which if I had sold in the near-peak ~15,000 range would have been worth 37,000 dollars.

I can’t imagine anyone deciding to jump in near 20k, it was so clearly a bubble, if you wanted in when it hit 20k, you were already too late.

Hindsight is great, but trying to time a bubble market is not a good investment strategy.

If you are imagining perfectly timing the BitCoin spike, why not imagine perfectly timing the stock market?

Sure, but a 2,000% increase on 2,000 dollars is a lot better than what you could have done in the stock market. The best stocks of 2017 only got near 150% increases on the year.

This was an insane bubble, and informed folks (us) would have known to get out when it hit like 15k. (I probably would have been happy at 10k a bitcoin) it is the people that tried to get in sept-oct 2017 that boosted the prices so high.

I mean, bitcoin is still at over 4,000 a coin, which is a huge jump from the Jan 2017 price of 800/coin.

True, but if one got in when they were worthless, that’s not a terrible deal.

Assuming one can afford to basically burn a few grand in a trashcan and not care about it anyway.

Can I pay my taxes in corn?

At least it has an intrinsic value.