The former prime minister is a crook. As the people live in abject poverty he resides in a massive glass mansion. The taxpayers of Georgia are literally paying out of pocket for this crap.

It’s about to get worse.

A fool and his money, and all that jazz.

While I’ve previously understood the conceptual value of a hard-audit trail that the blockchain provides, I feel like that audit report is the first time that I’ve seen it in action. It’s kind of neat.

Oh wow, I just read that. Fascinating. I don’t know much about crytpo-anything, but I do know I’d be in way over my head putting money into this junk.

So does this mean graphics cards are going to drop in price in the near future?

So far that hasn’t happened, even though the bottom dropped out on Nvidia. They don’t have any real competition anyway, since AMD has decided to match their price per performance and not undercut them.

It’s sad the guy has lost his life savings but how seriously stupid do you have to be to dump all of your money into crypto currency, and in one exchange at that.

Very!

I mean he was going to lose the value one way or another, even if the exchange didn’t lose/steal it.

So a crypto evangelist friend on Facebook is saying people should buy in again. Anything change to make him so bullish or like the last boom is it speculation on speculation?

Cryptocurrencies are by definition speculation, because they have no underlying value.

All the crypto news I’ve been hearing lately is bad-- hacks on exchanges, bugs and insecurity in the protocols, 51% attacks.

Bitcoin has hit a level of support at about $3,500, but it has hit several of those on its way down…

None whatsoever. Avoid, avoid, avoid.

I am shocked, SHOCKED, to see that there might be some fraud involved in this story. SHOCKED.

A whole bunch of securitised tokens have come up or are launching. They look more interesting, but their value lies more in utility than speculation. Not sure if this would interest punters at all.

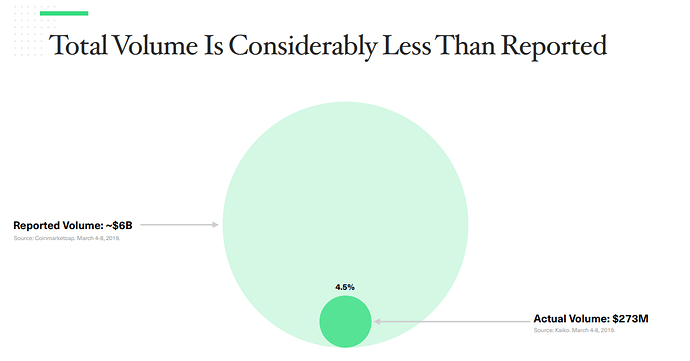

Big new report out today from a company that wants to list a bitcoin ETF. They find that almost all reported bitcoin volume is fake. Shocker.

Report is here:

Story about it here (paywalled):

Money shot from the research:

The takeaway being that the market for cryptocurrency is much, much, MUCH smaller than people say it is/is being reported, but that if you can weed out the fake volume, you can find a real, tradeable commodity.

And why would all this trading be faked, you ask? Because these cryptocurrency exchanges demand exorbitant fees just for listing a new coin offering. It’s in their best interests to inflate how much money is flowing through their exchanges.

Pretty much every word of that is false.

Also, you’ve gotta love a pitch for the SEC allowing an ETF that is basically: “Our underlying is rife with fraudulent activity and is much less liquid than it appears”.