Exactly, so they have to raise prices and cut services. While I’m sympathetic to your angst on the topic, I personally can’t really get too upset that an airline didn’t plan for a global pandemic that destroys their business. Because nobody, governments included, was really prepared for something on the scale of what’s currently happening.

My angst?

I think you’re attributing too much emotional response here based on what, the fact I disagree with you?

I don’t know how many times you expect our taxpayer money to bail out the same industry in one lifetime, but I’m thinking they might need to rethink what they’re doing. Before you continue to sympathize with them, do you even know how much cash they were carrying, how much liquidity they decided to keep on the books? It’s not as if this industry wasn’t brought to it’s knees before. What did they learn from the last time it happened?

Here I’ll give you the non-angst version:

It’s pitiful.

Profits into stock buybacks and executive compensation.

Pure avarice and greed, and they should not be rewarded for it. Bailout only with strings, namely ownership.

And yes I am saying partial nationalization. Treat it like any other investor cash infusion. You get the money in exchange for ceding some portion of control and ownership.

Totally agree. If we have to treat them like a public utility, let’s make them a public utility.

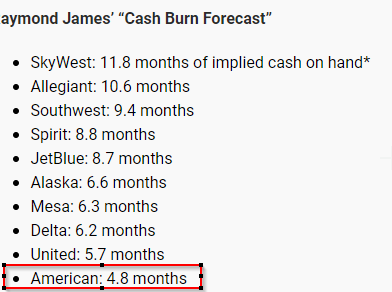

I am not sure we need to treat every airline exactly the same, but before we get our heart strings pulled for a specific company, let’s look in the list as to where American stands.

Yeah, that’s the bottom.

As someone who has flown American a ton, let me be the first to say, “fuck everything about American airlines”.

Not at all, and I apologize if I misread the tone of your posts. I just couldn’t (and don’t) understand why anyone feels it is comment-worthy that airlines are in dire financial straits and are forced to raise prices to remain viable as businesses after getting a bailout.

Yes, airlines have spent tons of cash on stock buybacks (aka tax-loophole-dividends) and executive payouts in the last few years. But that’s just par for the course for modern American corporations. Lots of business in all sectors have behaved the same way. Have the airlines don’t something special or different that makes them especially noteworthy?

That sounds like the most sensible plan, and I wish we had government more open to that kind of move. Bailouts where we just give free cash to businesses that are in a lurch are pretty silly.

Right, probably wouldn’t be the worse thing in the world if they went out of business. They were a dumpster fire before merging with USeless Airways, now they are beyond terrible.

Wouldn’t be the worst thing if United fell on their face either, though I do have decent memories of flying to/from East Asia on their 747s (domestically they are between “just ok” and “sucks”, depending on the route).

Fuck those guys in the ear. Time to re-outlaw stock buybacks.

And more

As a group, the six airlines spent 96% of their free cash flow on stock buybacks over the past 10 full years through 2019.

Boeing’s free cash flow for 10 years totaled $58.37 billion, while the company spent $43.44 billion, or 74% of free cash flow, on stock repurchases.

If AA had spent $12 billion on dividends instead of buybacks, would you think we should outlaw dividends too?

Except not all these industries had a bailout from before. I don’t actually expect every or even most industries/businesses to have enough foresight to prepare for world pandemics or terrorist attacks or the biggest hurricane we’ve seen in centuries, but this industry is somewhat unique in that they got a ton of cash before and apparently were not required to learn anything from that.

Even if you look across the same industry, American runs too light on cash. and they’re simply not entitled to rely on a bailout every 20 years if they, once again, don’t prepare. I’m not suggesting we let all of or even most of them fail, but if the people in charge can’t see the optics or the timing issue with this… maybe that person shouldn’t be in charge… or maybe we can do with one less airline.

Bad Year, Bad Luck or Bad Management? It sounds like it might be a combination for 2020 right, especially for American… but that isn’t the first time that kind of question has come up and no, it’s not ancient history the last time it was asked.

This is not their first rodeo. Maybe we should stop acting like it is.

Normal people are told to keep an emergency fund just in case something unforeseen goes wrong. Why shouldn’t companies do the same thing?

So yes, if they spent 90%+ of their cash flow on dividends, I’d say they were being extremely reckless.

The particular problem with stock buybacks is that it is practically straight-up graft. As we all know, most executives of public companies get their compensation primarily through stock value. So of course once stock buybacks were made legal again they pounced on them as an opportunity to line their own pockets.

Here’s a bunch of other people who are saying the exact same thing.

https://www.cnn.com/2019/02/26/perspectives/ban-stock-buybacks/index.html

I agree.

Why I say we take the pound of flesh or no bailout.

How about removing the entire governing board of each airline, or no bailout? Then replacing them with people who are honest.

HAHAHAHAHAHAHAHAHAHA!!!

Sorry. Couldn’t do it.

Companies have a strong incentive to send money to shareholders. After all, that’s the only reason why shareholders are shareholders. Banning stock buybacks wouldn’t change that. If you want companies to plan better for the long term, shareholders themselves need to change.

That’s not graft, that’s what everyone expects when compensation is tied to incentives. Again, banning buybacks wouldn’t change that. Companies would start rewarding shareholders with dividends, and then executive compensation would be tied to dividends instead.

Technically that’s just one person.

I disagree with her for the same reasons as above. Banning buybacks wouldn’t make shareholders care about increasing worker pay, so it wouldn’t change management.

She also argues that it distorts metrics like EPS. But that’s ridiculous, if a metric is flawed then you should simply ignore it. We all know that the Dow Jones is a flawed metric, for instance, it breaks whenever a stock splits. That doesn’t mean that we should ban stock splits.

I do agree that buybacks give shareholders an unfair tax advantage compared to dividends. The solution is to equalize their tax status.

I see what you are getting at, and I think I agree. But I honestly don’t blame the companies, The issue, as I see it, is the nature of the bailouts. The government has made it clear that they are willing to offer no-strings-attached bailouts if things go wrong, so why plan for a rainy day? I think the airlines have done sane rational contingency planning and their contingency plan is . . . ask the government for money. And they always get it.

Which is exactly why there should be strings.

Whelp, we can fix this, and it’ll be a lot easier to do that if they keep up with generating all this “good” will. Heck I’d be ready now. Sacrifice the one least prepared, no golden parachutes for anyone. The debtors can get the scraps to ensure no one winds up happy when they rely on the government for poor planning.

I am ok with that plan.

American, guess what’s on the menu?