I think the ideal government composition of whatever remains after deep cuts for the GOP would be something like 90% military and 10% televangelists. Get rid of all those evil programs that help minorities and the non-rich and they’d have the perfect trimmed down administration.

This is like saying “I’d rather eat peanuts than the alternative.”

Another one for @Malathor

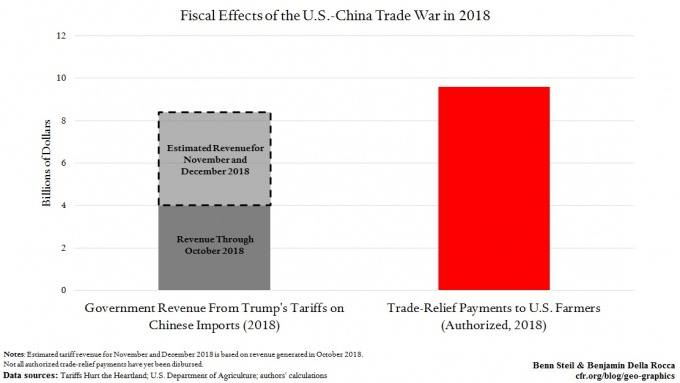

Still think the trade war is working out for us? Here’s the thing, even if China gives a tiny bit, what we lose here… we lose permanently. Russia and China tighten their friendship knot, and wherein the average Chinese citizen used to love the US, they are now starting to hate us. India and Pakistan don’t have the money China did to pay better prices for our goods, so even if we end up exporting to them to make up the difference - we lose.

There’s not enough there to determine whether I agree with you or not. There is more than one possible capitalist society, and more than one view of how to compensate labor. I’m guessing you would far rather be a worker in the capitalist society of, say, 1965 than the one we have now.

I’m guessing almost everyone can agree with that in principle, but the heart of the issue is what constitutes reasonable regulations and a reasonable safety net. As it is, it’s perfectly clear that capital intends to keep raping labor until someone stops them; and at the moment, government is largely content to let them keep doing it.

There is a big issue, which I glossed over: having money makes it easier to make more money; there is a strong positive feedback loop. And the logical corollary to that is that having less money makes it harder to make money. On top of that, having more money gives you unequal power in our political system due to our F’ed up institutions.

So part of “reasonable” means we have to address two things:

1)First, you have to try to avoid the things that favor the wealthy by default, or by corruption/self-dealing, like preferential tax treatment for forms of income favored by the wealthy or regressive taxes like capped payroll taxes or consumption taxes, plus a whole host of other stuff. For example, rigorous anti-trust, and vigorous protection of consumer and worker rights are necessary. I understand this can go too far but right now the pendulum is way in favor of wealth.

2)Second, even if you avoid overt favoritism to wealth, the inherent positive feedback loop of wealth in a capitalist society will still create a relative disadvantage to the less wealthy. Therefore, a “reasonable” mixed economy has to do things to create base-level opportunity for the less well-off. This includes the standard liberal agenda like investing in health care, education, and infrastructure, as well as providing reasonable avenues for collective bargaining, but I’d also like to see some test programs helping to create further opportunity at the low-wealth end. I’m not sure what exactly will work: public or private programs to assist with small-scale capital formation (starting small businesses for example), maybe a re-thinking of dividends such that some fraction of dividends must be provided to labor. I’m also open to experimenting with jobs guarantees and basic incomes but I’m honestly not sure how well those things will work. I am open to further suggestion on this point.

So true. I think if I just had my college paid for, a massive down payment on my first house gifted to me by my parents, and interest-free loans from the same like a couple of my friends (libertarians, of course) from back in high school had? And we’re still talking middle class here, not trust fund kid and guaranteed trip to an Ivy League education or anything. What a difference that could make.

I have no objection to either of those things, but I don’t see how they’ll do anything to combat growing inequality. For that, you need to tax back the excessive income going to the wealthy and redistribute it to everyone else. I suppose it would be simpler to tightly regulate compensation, e.g. impose pay caps on rich jobs and have an aggressive minimum wage policy, but it doesn’t seem possible to sustain those. So, tax the fuckers.

*NB: I am, or at least was, one of the fuckers.

Starting to look like Huawei is just an agent of the Chinese government.

Remember when trump was all worried about those zhuweii employees being out of work?

We’ve suspected that for a decade.

We’ve straight up known about it.

ZTE…

If the president’s policies were working as planned, the steel industry should outperform other sectors. Yet as the graphic above shows, since Trump announced steel tariffs on March 1, 2018, steel-producer stock prices have plummeted 22 percent —while the S&P 500 index has fallen only three percent.

I guess there is so slim hope that a court may rule that the Congress delegation of tariff authority maybe unconstitutional.

Guess that means we won’t be negotiating trade deals for brassieres.

So much winning.

Right smack dab in the middle of infrastructure week too.